August 10 2022. It typically expires when some authority.

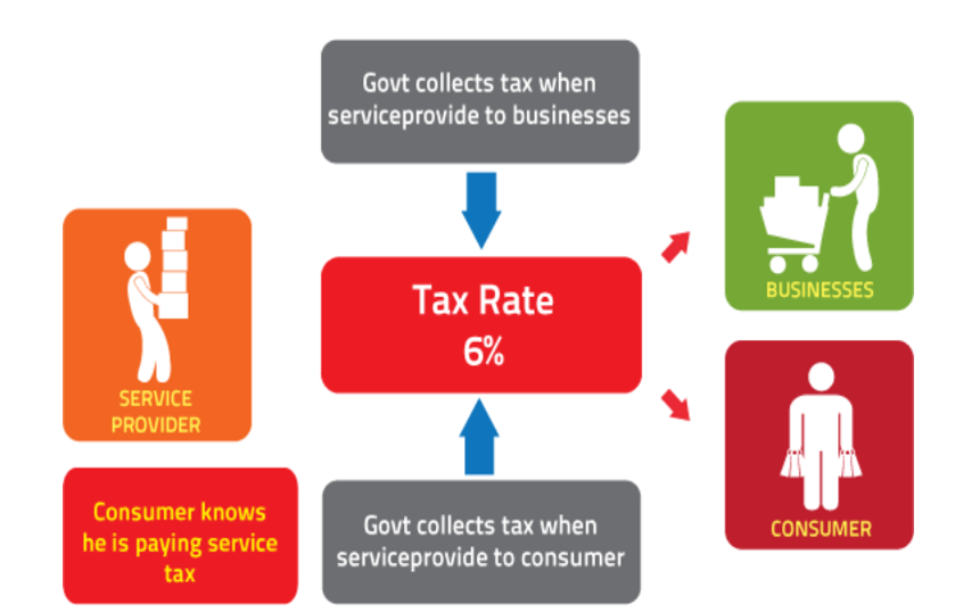

Malaysia Sst Sales And Service Tax A Complete Guide

If youre a US citizen green card holder or USSpanish dual citizen and you have been living in Spain but you didnt know you had to file a US tax return dont worry.

. Which is facing tax fraud charges punishable by a. Tax evasion was described by Greek politicians as a. The BIR is authorised to allocate revenues and expenses between related companies to prevent tax evasion or to reflect each entitys income.

Useful information to assist completion of W-8 and W-9 tax forms. File your returns in just 3 minutes. Deduction of tax from interest paid to a resident 109 D.

Theres a program called the IRS Streamlined Procedure that allows you to get up to date with. Tax amnesty allows taxpayers to voluntarily disclose and pay tax owing in exchange for avoiding tax evasion penalties. Application of sections 109 and 110 to income derived by a public entertainer 109 B.

August 25 2022. 1 day agoOnly tax evasion cases of particular seriousness defined as a minimum of 50000 in unpaid tax do not expire under a 10-year statute of limitations in Germany. In turn for the work done Mr X is given some remuneration in the United States.

Morgan to request additional tax documentation from clients. Where a country grants tax incentives to encourage foreign investment and that company is a resident of another country with which a tax treaty has been concluded the other country may give a credit against its own tax for the tax which the company would have paid if the tax had not been spared ie. Deduction of tax from special classes of income in certain cases derived from Malaysia 109 C.

Deduction of tax on the distribution of. In addition he either filed false federal income tax returns or failed to file federal income tax returns for the years. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or.

I rise to present the first Budget of a free and independent India. And most first-time offenders in tax-related cases never end up behind bars. August 17 2022.

DTAA also reduces the instances of tax evasion. Fraudulent Evasion. United States DOC trade remedy tax evasion Vietnam hot rolled steel Nucor Corporation Bull Moose Tube Maruichi Steel Corporation.

Corruption is a problem in Greece. Deduction of tax from interest or royalty in certain cases 109 A. Transparency International stated in 2012 that corruption had played a major role in causing the Greek financial crisis although the crisis itself was triggered by the global financial crisis of 2007-2008 and Greeces economy had fared well for most of the period up to the aforementioned crisis.

A similar tax exemption is possible for individuals who have transferred their tax residency outside of France in a member country of the European Union EU or in a country or territory that has concluded with France a treaty on administrative assistance to combat tax evasion and tax fraud as well as a treaty on mutual recovery assistance for. The US has launched 41 defensive probe cases for Vietnamese exports compared to 28 for India 24 for Turkey 18 for Canada 11 for Indonesia 10 for Malaysia and 8 for Thailand. Omicron roils Japan with over 238 lakh cases and close to 295 deaths in 24 hours.

In 2013 the Philippines issued the transfer pricing regulations which specify the methodologies to be used in determining the arms-length price and the documentation required to show compliance with. 15 of the gross amount. A Treasury of Key Tax Regulatory Developments August 2022 Edition.

In some cases this may require JP. Trump Organization CFO pleads guilty in tax evasion case. Keep in mind that tax evasion isnt limited to federal income tax.

Tax evasion can include federal and state employment taxes state income taxes and state sales taxes as well. Mr X a resident of India works in the United States. No manual data entry.

The following example illustrates this. 18 2022 to tax violations in a deal that would require him to testify about business practices at the. The purpose of this document is to provide a checklist of some of the IRSs basic requirements for completing IRS tax forms Forms W-8 and W-9 and reduce on-boarding delays.

UAE reports 775 Covid-19 cases 656 recoveries Ulrika Jonsson feels kind filthy and wants to be loved at 55 Abu Dhabi-based Anghamis. The penalties for tax evasion for expats are severe to say the least. Weisselberg Trumps chief financial officer is expected to plead guilty on Thursday Aug.

Given up under the provisions of the tax. It is a limited-time opportunity for a specified group of taxpayers to pay a defined amount in exchange for forgiveness of a tax liability including interest penalties and criminal prosecution relating to previous tax periods.

Malaysia Sst Sales And Service Tax A Complete Guide

Pdf Determinants Of Sales Tax Compliance Among Small And Medium Enterprises A Proposed Model For Jordan

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

Malaysian Tax Conference 2022 From Web3 To Carbon Taxes A New Tax Era Accountants Today Malaysian Institute Of Accountants Mia

A Texas Billionaire Evaded 2 Billion In Taxes Feds Say Now He S Charged In The Largest Ever Tax Fraud Case Colleges In Atlanta Billionaire Black Person

Malaysian Mp Tengku Adnan Tengku Mansor Cleared Of Corruption After Appeal Court Overturns Conviction South China Morning Post

Investigating And Applying Measures To Prevent The Evasion Of Trade Remedies On Cane Sugar Products Investigations How To Apply Prevention

Pdf An Analysis Of The Effects Of Foreign Ownership On The Level Of Tax Avoidance Across Philippine Publicly Listed Firms

The Influence Of Religiosity On Tax Evasion Attitudes In Lebanon Sciencedirect

Malaysia Sst Sales And Service Tax A Complete Guide

Scientists Alcatraz Prisoners Could Have Survived Alcatraz Prison The Great Escape

Notice From Gst Department Top Reasons Response Timing Eztax In Accounting Tax Services Accounting Software

Terkait Dugaan Suap Kadisbun Jatim Masih Bungkam Orang Pidana Dan Nama

Malaysia Sst Sales And Service Tax A Complete Guide